|

Matters Pecuniary ... credit cards, banking, debt management, |

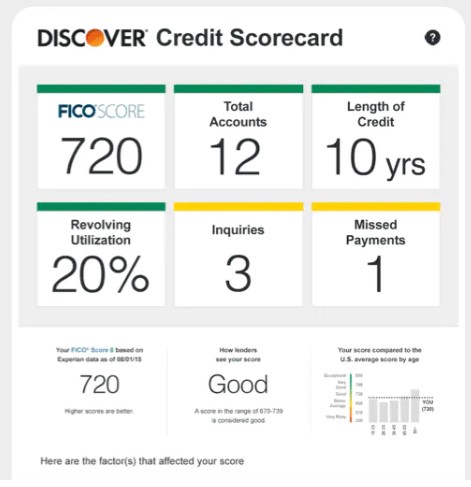

What happened to creditscorecard.com?

Creditscorecard.com currently redirects visitors to a Discover.com page. Discover offered afree credit monitoring service through Creditscorecard.com. The service was available to the public and was discontinued in June of 2022. While Creditscorecard.com was in operation, Discover also offered a very similar credit monitoring service to its credit card customers. That service is still available to Discover credit cardholders. Both Creditscorecard.com and the service restricted to Discover customers allowed users to track their real credit score (FICO) each month. The only difference between the two services is that the Experian FICO 8 was available through Creditscorecard.com and …