|

Matters Pecuniary ... credit cards, banking, debt management, |

Enzo announces the termination of its cashback program

Enzo announced on March 10, 2023 that it has ended its cashback program as of March 10, 2023. Users are instructed to visit help.joinenzo.com for more information.

One day after the announcement, Enzo has still not documented the details of the end of its cashback program on the page that it directed users to. The cashback program is still advertised throughout Enzo’s site.

However, an email sent to customers confirms the end of the Enzo cashback program.

“We have some sad news to share. Unfortunately, we’re terminating our cashback rewards. Cashback rewards for the month of February will be paid out in the coming days. Rewards accrued through March 10th will be paid out at a later date. All other cashback rewards earned after March 10th that have not been paid out will be forfeited as a result of the termination of the program.”

There have been grumblings from customers about Enzo’s delays in providing cashback in recent months and the fintech’s silence about critical events, like their recent outage that left some Enzo customers wondering what would happen to their scheduled bill payments and transfers.

The end of the cashback program shouldn’t be surprising. The writing was on the wall. We briefly touched on Enzo’s discontinuation of their premium cashback program, which was set to end in May.

When a new fintech ends a program, that’s not a good sign. But, the end of this particular program was suspicious as it actually provided Enzo with cashflow and free marketing. In order for customers to receive the cashback, which was capped at $20 a month or $150 a year, customers were required to deposit $1,500 a month, maintain a minimum account balance of $2,000 per month, or share at least 5 transactions a month on social media.

Enzo is also going through a brand identity crisis. There was their attempt to launch Enzo MoneyRing. Or, was it Enzo Money Ring? The service is spelled both ways, sometimes, in the same promotional material.

Even today, Enzo is still not sure how it wants to represent itself. In the past, Enzo courted customers looking to save money via cashback on their rent and mortgage payments and Uber and DoorDash. Now, Enzo touts itself as “finance for millionaires.”

In its Twitter marketing, Enzo resorted to money shaming Twitter users who may be wondering what MoneyRing. Enzo says, “If you have to ask, you can’t afford it.”

The accompanied video told users to stop watching if their net worth was less than $2 million.

After their psychological tricks failed, Enzo did a turnabout and told practically begged users to participate in their marketing scheme and retweet the ad for MoneyRing. The original tweet only has eight retweets and the follow-up tweet has just one retweet.

It appears that Enzo is trying to find its footing by courting a new customer base while neglecting the customers that it currently has.

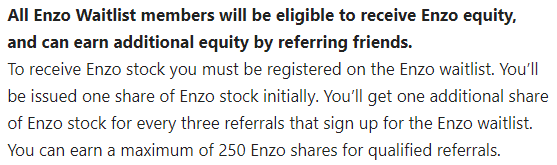

As always, you should be wary of strangers touting products and services, especially when it’s related to money. You might encounter Enzo founding members who’ll try to assure you that all is well with the company when their intent is just to safeguard their equity stake in Enzo.